Compare Loan types

Find the Right Fit...

Without the Guesswork

See how popular loan programs stack up and discover which ones might match your goals, budget, and timeline

Conventional Loans

A popular loan option for buyers with solid credit and steady income. Conventional loans offer flexible terms, competitive rates, and mortgage insurance that can be removed once enough equity is built.

FHA Loans

An FHA loan is designed to help buyers with lower credit scores or smaller down payments. These loans offer flexible guidelines and are a common choice for first-time homebuyers.

VA Loans

VA loans are available to eligible military service members, veterans, and surviving spouses. They offer no down payment, no monthly mortgage insurance, and competitive interest rates.

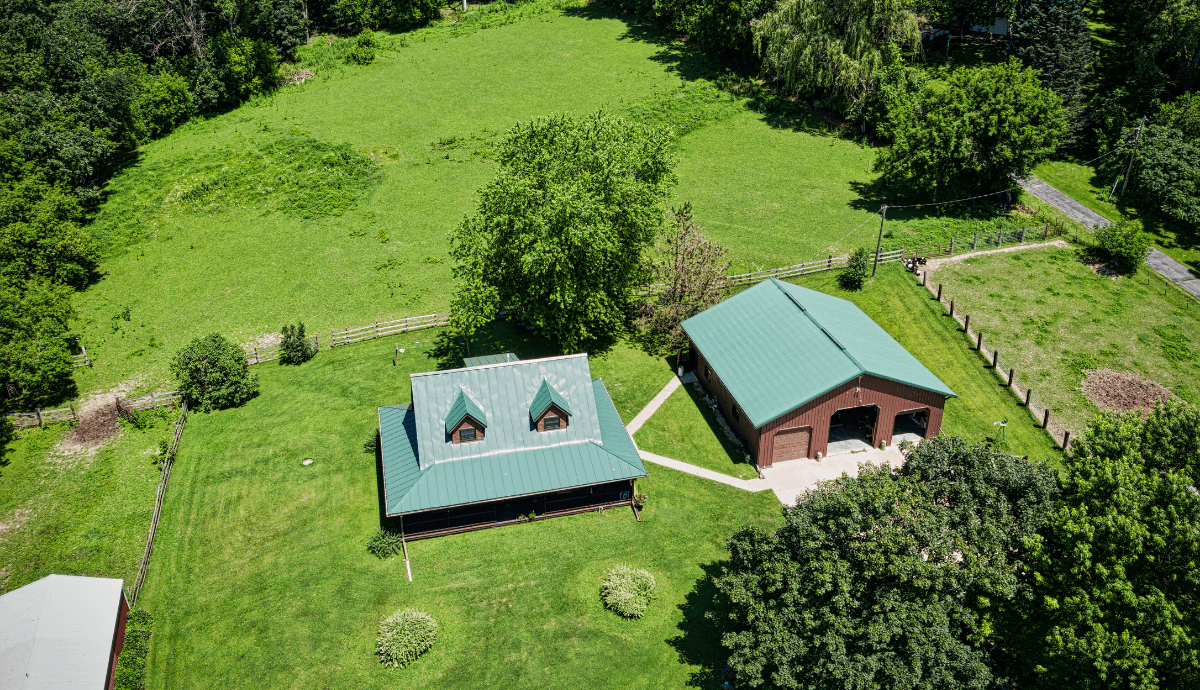

USDA Loans

USDA loans help buyers purchase homes in eligible rural and suburban areas with no down payment. They offer affordable payments and low mortgage insurance costs for qualifying buyers.

Investment Loans

Loan options designed for real estate investors purchasing or refinancing rental properties. These programs offer flexible qualification options, including alternatives to traditional income documentation.

Non-QM & Other Options

Not every borrower fits into a traditional loan box—and that’s okay. Non-QM and other alternative loan options are designed for buyers with unique income, assets, or property goals who may not qualify under standard guidelines.